Setting up taxes and surcharges allows you to ensure compliance with local regulations and provide accurate pricing to your customers. Whether you're dealing with various tax rates across different regions or implementing surcharges for specific services, this guide will help you navigate the setup process.

Tax vs. Surcharge

- A tax is a mandatory financial charge imposed by a government authority, typically calculated as a percentage of the sale price, which businesses are required to collect and remit to the government. For example, sales tax or VAT is applied to most goods and services.

- A surcharge, is an additional fee that a business may choose to apply on top of the standard price of a service or product. Surcharges are not mandated by the government but are often used to cover extra costs associated with providing a service, such as launch fees or environmental charges. Unlike taxes, surcharges are discretionary and can be adjusted or waived by the business.

How to Set Up Taxes & Surcharges

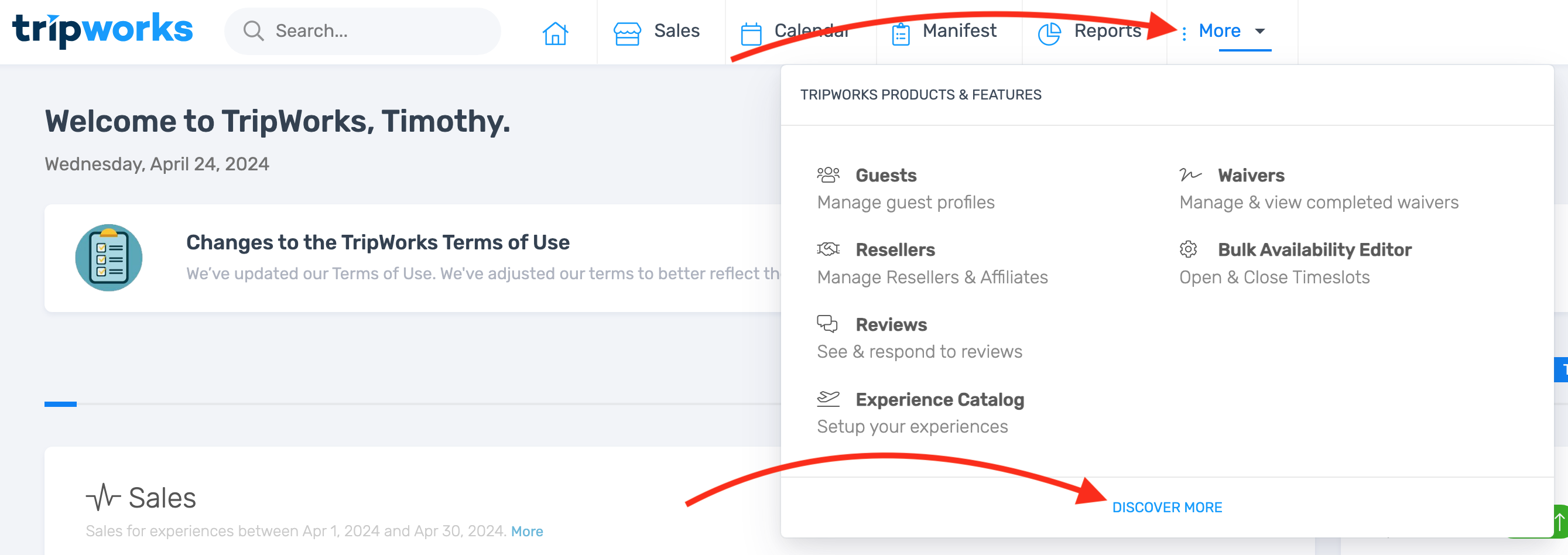

- From within your dashboard, select More > Discover More from the toolbar

- Choose Taxes & Surcharges from the Setup & Configuration menu

- Select "Enable this Tax/Surcharge" under an available Tax tab

- Add a Label for your tax or surcharge (e.g. “Sales Tax”, “Amusement Tax”, “VAT”, “Launch Fee”). This label is displayed during checkout, on customer receipts, and on reports

-

Enter either a Percentage or Fixed Amount

- Percentage: Use this for charges like Sales Tax or VAT. Choosing this option will apply a percentage of the total trip cost

-

Fixed Amount: Use this for charges such as Launch Fees or Fuel Surcharges. When using Fixed Amounts, you can select how the surcharge is applied:

- Apply this surcharge/fee once per trip: The fee will be applied once to the total trip cost, regardless of the number of guests

- Apply this surcharge/fee once per booking: The fee will be applied to each individual ticket. For example, if 5 people are booked, each ticket will include the additional fixed charge

- Select the activities to which this tax/surcharge should apply. If it does not apply to a specific activity, simply leave the box unchecked

- Decide if this tax/surcharge should be applied to products (if applicable). If it does not apply to all or certain products, leave the box unchecked

-

Select which channels this tax/surcharge should apply to. Channels refer to the Trip Methods, or how the trip is booked. If it does not apply to all or certain channels, leave the box unchecked

- E-commerce Trips: Apply this tax/surcharge to all trips created through your website (also known as an “online” or “e-commerce” trip)

- Walk-Up Trips: Apply this tax/surcharge to all trips created by a team member (also known as an “offline” or “walk-up” trip)

- Offline Resellers: Apply this tax/surcharge to all trips created by a partner (also known as a “private partner” or “offline reseller”)

- OTAs (Online Travel Agencies): Apply this tax/surcharge to all trips created by an OTA (such as Viator, Get Your Guide, Expedia etc.)

Want to apply a tax or surcharge to only certain OTAs or Resellers?

You can apply a tax or surcharge to specific booking channels, including individual OTAs or private resellers.

For example, if you charge a processing fee for certain private resellers who require manual invoicing or extra handling, you can apply that fee only to select Offline Reseller bookings by choosing “Limit to Specific Resellers.”

-

Choose (optional) Advanced Options

- Tax/Surcharge is Earned Income: Choose this option to include the tax/surcharge in your Net Sale figures on your reports

- Include Tax/Surcharge in Price: Select this option if you want the surcharge to be included in the total amount due at checkout, instead of a separate line item

- Exempt by Default on New Trips: Enable this option if you want this tax or surcharge to be excluded by default when new trips are created. When enabled, you must manually apply it to each trip.

- Select Save